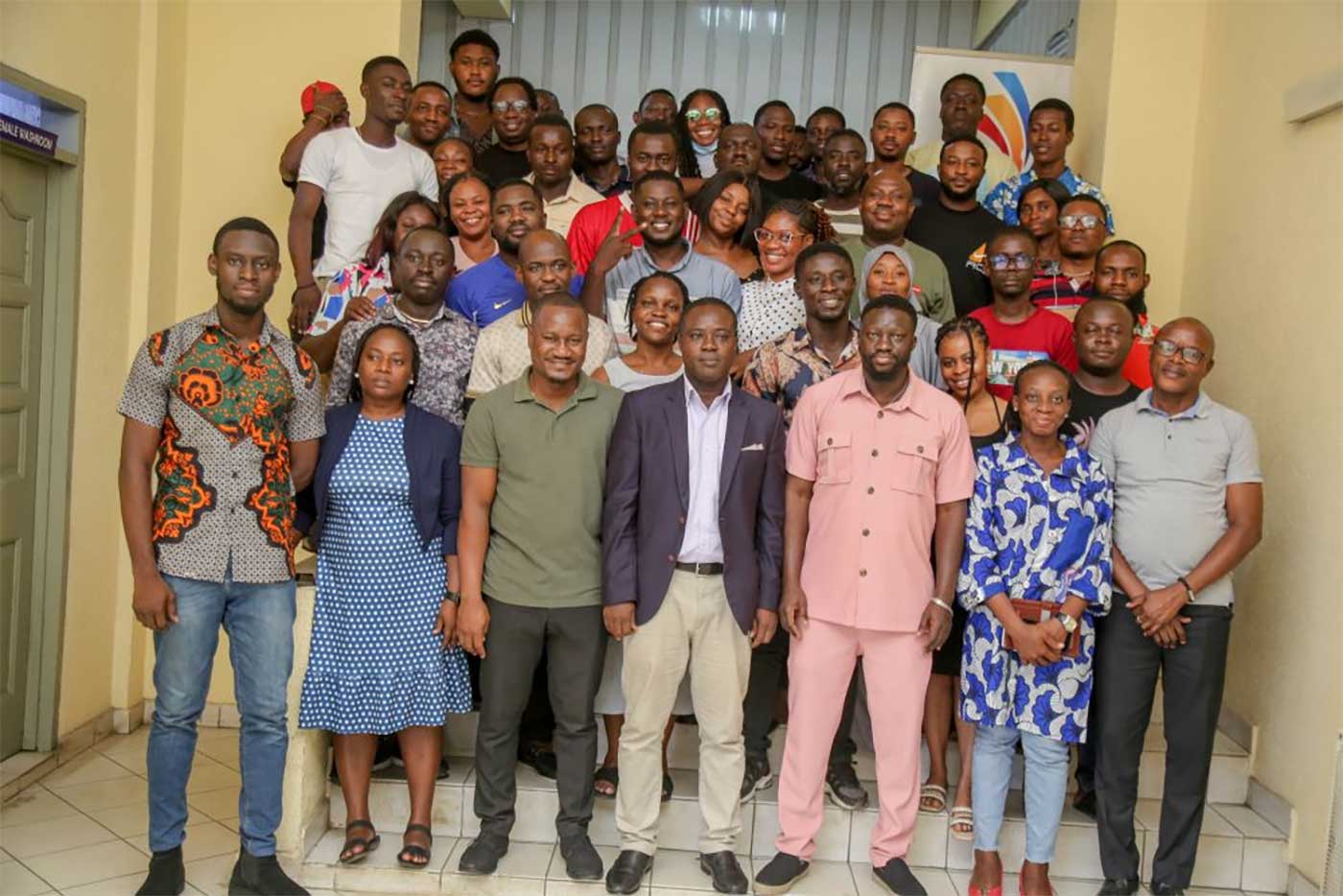

The Department of Accounting, Banking and Finance of the GCTU Business School, in collaboration with Prymage Consultancy Ltd has trained its Level 400 students in modern Accounting software skills at a four-day programme from July 20, 25, 26 and 27, 2024.

The training, which was held at the school, aimed at providing students with practical insights into the latest accounting practices and technologies, focusing on Tally Prime 4.0 and Payroll Modules and keeping them abreast of current trends.

Giving his remarks, the Dean of the Business School, Prof. George Ampong, said that in line with the GCTU mandate, the Business School is focused on ICT-based education and training to deliver cutting-edge, tech-based business programmes. “The School regularly updates the knowledge and skills of faculty members and students through workshops, training sessions and industrial collaborations.

This training is part of a series of sessions on accounting software, necessary for computerized accounting,” he emphasized. Prof. Ampong noted that the training began in 2022 and it ensures that participants stay current with the latest developments in accounting technology and other programmes offered at the GCTU Business School, including Financial Technology, Digital Marketing, Human Resource Informatics, E-Procurement and Logistics, Economics and Analytics.

An officer from Prymage Consultancy Ltd. and a Facilitator, Mr. Samuel Opare, discussed an overview of tally prime 4.0, company creation, accounts and groups ledger creation, stock group, stock category, unit and location, stock item creation and alternation, vouchers, opening balance entries for accounts and inventories and multiple price level mgt basic. Mr. Opare highlighted the importance of Basic Security measures, stressing that enabling security controls is crucial for safeguarding company data. He pointed out that creating user access controls and administrator credentials is a necessary step in this process.

Another Facilitator from the company, Mr. Prince Quartey, gave a presentation on introduction to customized files, export to excel (PDF and JPEG), use of actual and billed quantity, cost center and cost center classes. Mr. Quartey highlighted password policy, stressing that a good password enhances data security and allows only authorized users to view financial data. “The Administrator can set a password policy in place, which users will have to adhere to when creating and managing passwords for the company,” he said.

Giving the closing remarks, the Head of the Department of Accounting, Banking and Finance, Dr. Emmanuel Attah Kumah Amponsah, indicated that the training is conducted every year and this year’s final-year students will be graduating at the end of this semester. “As part of their assessment, we are empowering them with the necessary skills to excel in the job market, where digitalization and software expertise are highly prized,” he said. According to him, Tally Prime has three levels of training: Basic, Standard and Professional. “Last year’s training was Basic Tally Prime, but this year’s training is Standard Tally Prime,” he said.

He again indicated that given the new programmes added to its five existing programmes with a host of newly developed technology-oriented courses, it had become increasingly prudent that such training sessions are organized to orient both students and faculty with the dynamics of the new modernized programmes which will roll out next year. The new programmes included First Degree and Masters programmes in Forensic Accounting, Financial Technology, Computational Finance, MPhil and PhD in Accounting and Finance and MSc in Accounting and Finance.

Dr. Amponsah also underscored the need to equip lecturers to effectively deliver these new programmes. He said that the Department will be holding faculty training programmes centered on the aforementioned Tally and Payroll Modules, as well as other Finance software (Fin-tech areas). The training is expected to focus on Machine Learning, Cyber and Data Security, Artificial intelligence in Finance, Blockchain in Finance and Value creation as well as other Forensic Accounting Software.

Dr. Amponsah hinted that next semester, the Department aims to fuse the existing academic qualifications with professional certifications which will provide students with the unique opportunity to acquire Institute of Chartered Accountants (ICA), Ghana, Chartered Institute of Financial and Investment Analyst, Ghana, Chartered Institute of Bankers (CIB), Ghana and Chartered Institute of Tax Law and Forensic Accountants (CITIFA), Ghana, certifications alongside their degree qualifications. This initiative he said will certainly go a long way towards increasing the value and marketability of the existing programmes.

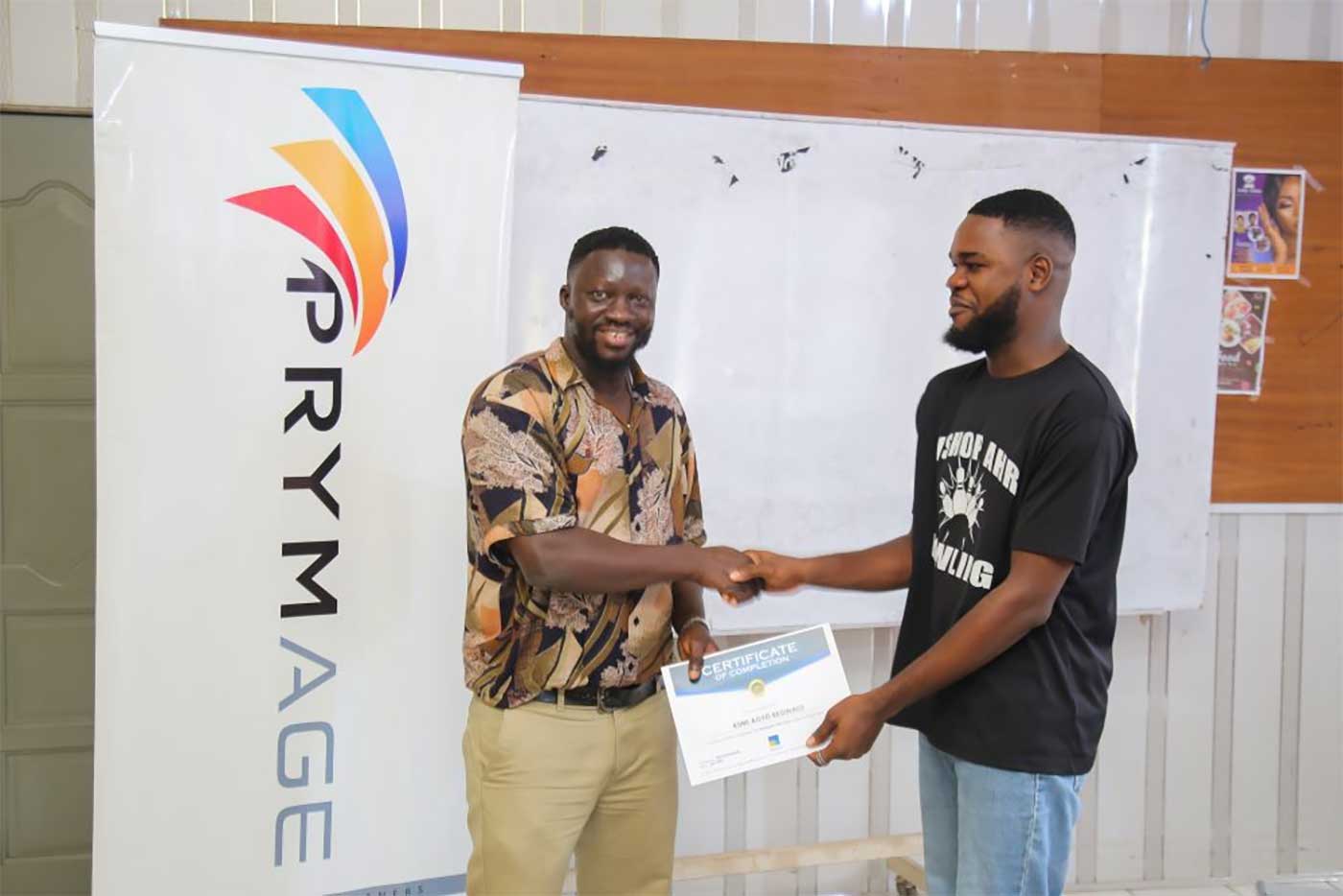

At the end of the training programme, participants were awarded certificates of participation. We commend the enterprise and foresight of the Dean, Prof. Ampong, the Head of Department, Dr. Emmanuel Attah Kumah Amponsah and the entire team as they continue to enhance the academic quality of the GCTU Business School.