The Centre for Strategic Business and Professional Development (CSBPD) of GCTU, in collaboration with the Department of Accounting, Banking and Finance at the Business School, has hosted a 5-day training workshop on forensic accounting and cyber security from 1st to 5th October 2024, at the main campus.

The training workshop, organized for professionals from diverse organizations, aimed at equipping participants with cutting-edge knowledge and skills in forensic accounting and cyber security, enabling them to detect, prevent, and respond to financial crimes and cyber threats in this digital age.

Speaking at the training, the Pro Vice-Chancellor, Prof. Robert Ebo Hinson, extended a warm welcome to the participants and encouraged them to fully immerse themselves in the learning experience. “The skills and knowledge you acquire will not only enhance your professional growth but also empower you to make a positive impact,” he added. He employed the Bible scripture in Daniel 1:20 to further admonish participants on the training prospects. He said, “May the knowledge and skills you gain during this training make you ten times better in your respective fields and may you become a blessing to others.”

Lead Facilitator and Head of the Department of Accounting, Banking and Finance, Dr. Emmanuel Attah Kumah Amponsah, delivered a presentation titled “Financial Statement Analysis: Using Ratios to Evaluate Firms’ Failures.” He explained the key components of financial statements, including the balance sheet, statement of profit or loss and other comprehensive income, statement of changes in equity, and statement of cash flows (IAS 1.10).

Dr. Amponsah outlined four stages in account interpretation: collecting, analyzing, interpreting, and reporting information. He described ratios as the comparison of one numerical value to another, expressed as a percentage or factor. He emphasized the critical role of ratio analysis in assessing a firm’s financial health, identifying areas for improvement, and supporting informed decision-making.

The Executive Director of the Chartered Institute of Tax Law and Forensic Accountants, Ghana and Resource Person, Mr. Eric Oduro, shed light on “Forensic Accounting and Fraud Examination.” He explained that forensic accounting and fraud examination involve using electronic techniques to identify irregularities, analyzing evidentiary materials and making informed decisions using analytical techniques.

He stated that by carefully analyzing a company’s financial statements, such as the statement of financial position, statement of income and statement of cash flow, experts can identify potential red flags. He however, cautioned that some fraudulent activities may not be immediately apparent in the numbers alone. Mr. Oduro underscored the importance of scrutinizing narratives in footnotes, quarterly earnings, releases and other publicly available management representations. This detailed analysis, he said, can reveal inconsistencies and potential fraud.

Dean of Student Affairs, Prof. Michael Nana Owusu-Akomeah, provided valuable insights on “Tax Audit.” He defined tax as a compulsory government levy on individuals or businesses to generate revenue for public purposes and support broader fiscal policy and macroeconomic objectives. He explained that the main purpose of taxation is to raise revenue for public needs and outlined the two types of taxation: direct and indirect. Prof. Owusu-Akomeah further described a tax audit as the examination of an individual’s or organization’s tax records and financial information to ensure accuracy and compliance with tax laws and regulations.

The Dean of FoCIS, Dr. William Leslie Brown-Acquaye, discussed “Cyber Security and Digital Forensics.” He indicated that cyber security is crucial in today’s digital age and its importance cannot be overstated. The Dean outlined the risks associated with neglecting cyber security. According to him, cyber security is the protection of internet-connected systems, including hardware, software and data, from cyber attacks. He emphasized that the persistent threat of internet attacks is a societal issue facing all industries, especially the financial services industry. Dr. Brown-Acquaye further outlined the importance of cyber security, including, identity theft, monetary theft, legal ramification (oneself and organization) and sanction or termination, if policies are not followed.

The Head of Computer Science Department, Dr. Emmanuel Freeman, touched on “Ethical Hacking and Simulations.” In his presentation, he indicated that hacking is an activity done to intrude someone’s personal information space to use for malicious unwanted purposes. He highlighted the hacking statistics, stating that every 39 seconds, there is a hack attack. Dr. Freeman defined ‘ethical hacker,’ as a person who hacks into a computer network in order to test or evaluate its security, rather than with malicious or criminal intent. He delved into the types of ethical hacking, namely, mobile hacking, internet of things hacking, network hacking, web application hacking and many more.

Another Resource person, Mr. Osei Mensah, delved into “Financial Crimes, Regulatory Breaches and Credit Risk.” He elaborated that regulatory breaches refer to all forms of non-compliance with applicable laws/acts, directives and public notices that govern the licenses issued to a regulated financial institution. He further explained that financial crimes encompass various illicit activities involving financial systems, institutions and instruments.

Another Facilitator, Mr. Geoffrey Ahiable (Esq.), gave a presentation on “Forensic Law and Criminal Investigation.” He noted that criminal investigation involves logical steps establishing a progression that can be followed and repeated to reach the desired result. He highlighted the procedures of criminal investigation, including investigative task and thinking, follow-up, case analysis and strategy, arrests and charging and court proceedings and case closures. Mr. Ahiable Esq. elaborated on types of forensic analysis, namely, fingerprint, handwriting, ballistics, DNA and accounting.

In a presentation by yet another Facilitator, Mr. Stephen Osei, he provided insights into “Special Investigations & Tax Laws.” He emphasized that there are various types of taxes, backed by different Acts of Parliament or laws, which regulate how taxes are administered in the country. Mr. Osei cited vital tax laws backing some tax types in Ghana.

Giving his remarks, the Dean of the Business School, Prof. George Ampong highlighted the significance of networking as a key benefit of participating in training programmes. He called for strong relationships among participants, facilitators and University staff. Prof. Ampong charged participants to become ambassadors of the training workshop, spreading the benefits of the knowledge and skills acquired to their organizations. “Any time you find yourself in any environment, make the most of the place. At GCTU, we offer exceptional programmes, both local and international, combined with quality tuition,” he indicated.

Earlier, the Director of CSBPD, Mrs. Araba Hackman Akanji, warmly welcomed the participants to the workshop. “The facilitators are seasoned experts in their fields, dedicated to guiding you through a transformative learning experience. We have carefully crafted the curriculum to meet your needs,” she noted.

In her closing remarks, Mrs. Akanji expressed her heartfelt gratitude to the facilitators, participants and training coordinators for a successful workshop. “Thank you for participating in our training programme. Your feedback is crucial in helping to continue to deliver exceptional training experiences,” she said.

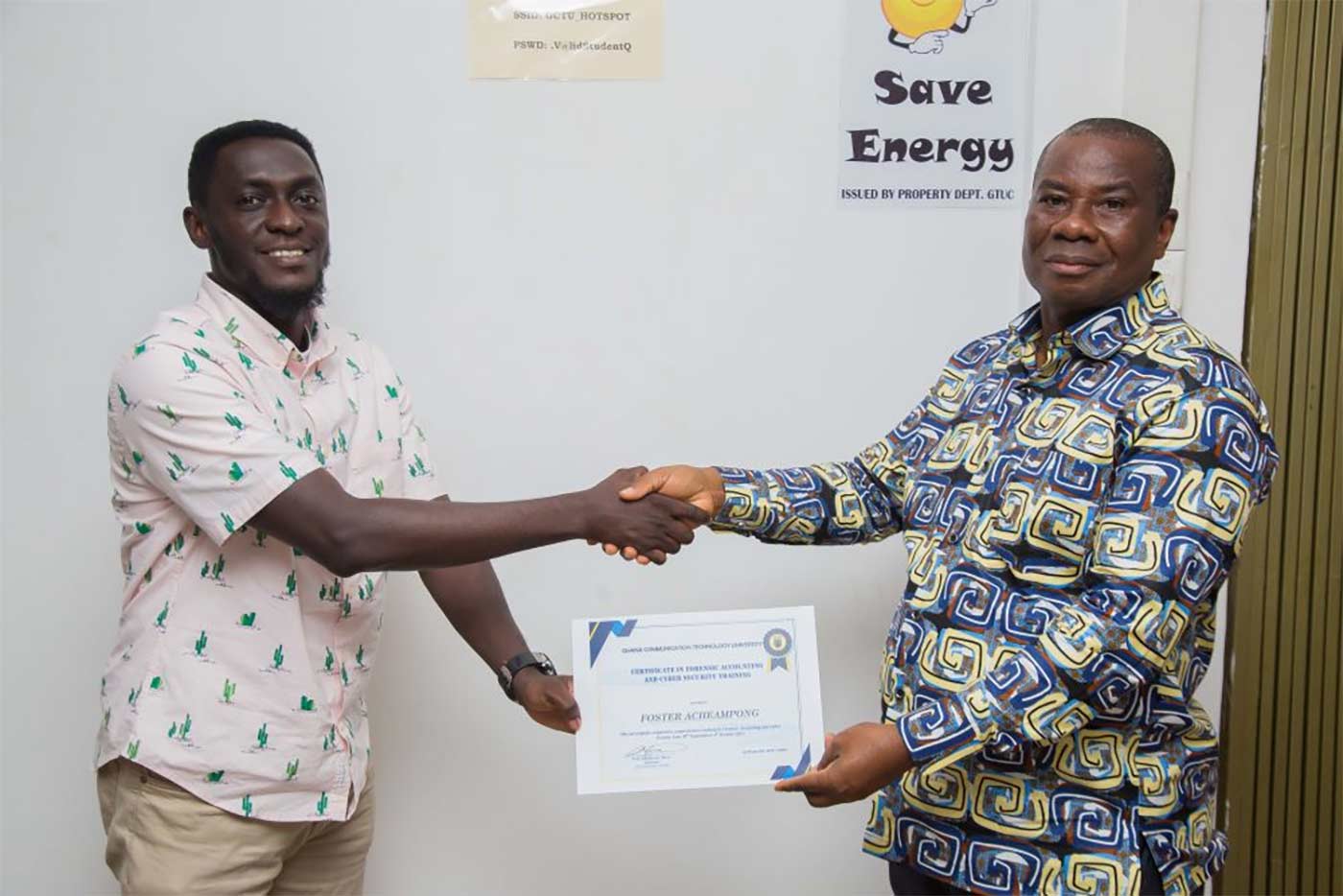

At the end of the training programme, participants were awarded certificates of participation.